Measured Moves in Trading

Measured moves are predictive techniques traders use to estimate how far a price move may extend based on previous price action.

Measured Move Tools

Fibonacci Retracements

→ Identify potential pullback levels within a trend.Fibonacci Extensions

→ Project future price targets based on previous swings.Quadrants Tool

→ Divide a move into equal sections for precise target setting.

Types of Measured Moves

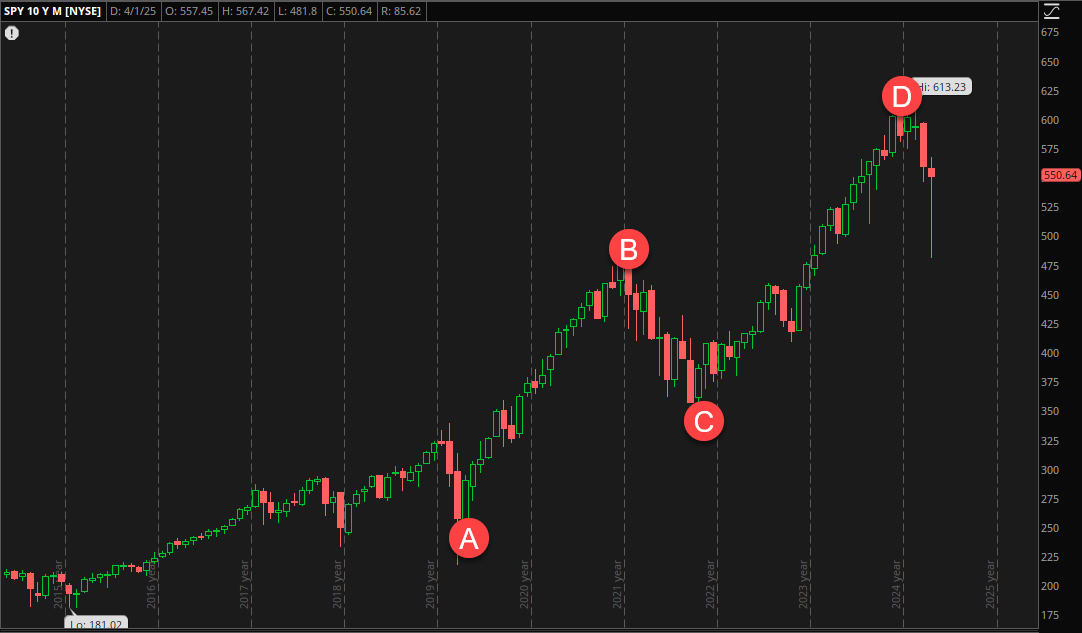

1. ABC Pattern

- A simple three-leg movement:

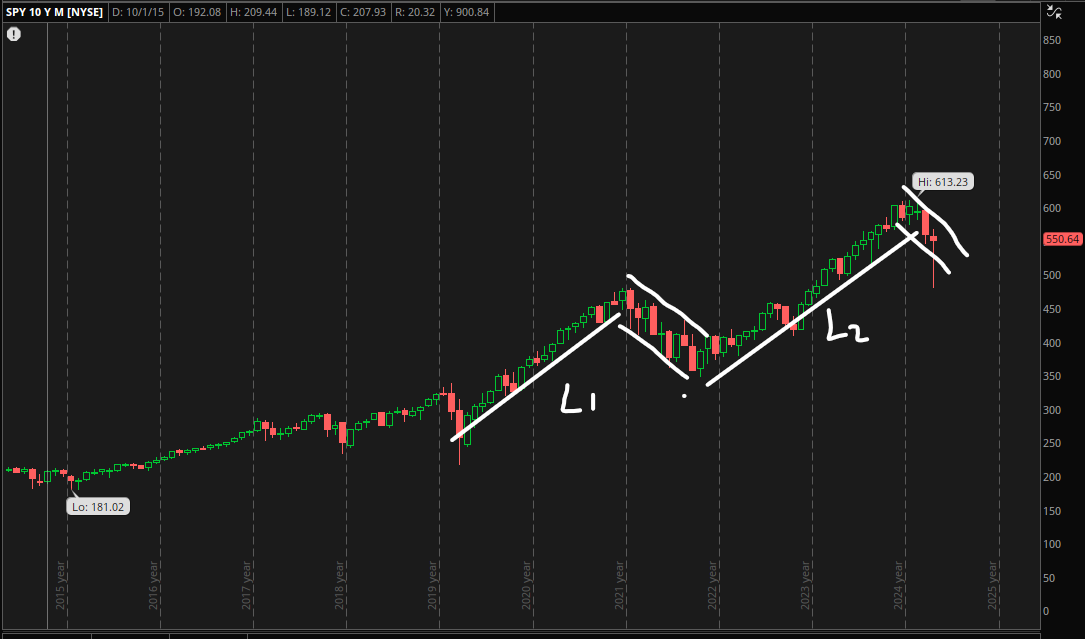

2. Leg 1 = Leg 2 (Symmetrical Move)

- The second leg of a trend is often equal in length to the first leg.

- Common in strong, trending markets.

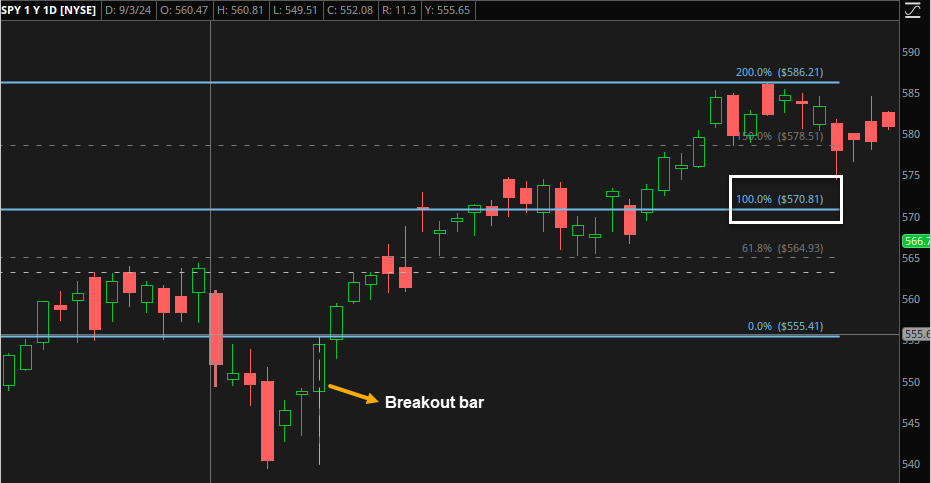

3. Height of Trading Range

- Measure the vertical distance between the top and bottom of a consolidation range.

- Project that distance upward or downward after a breakout.

4. Height of Breakout

Breakout Bar + Follow-through Bar

- Strong breakout confirmed with immediate follow-through.

- → Expect a measured move in the direction of the breakout.

Breakout Bar + No Follow-through

- Breakout fails, market reverses quickly.

- → Expect a measured move in the opposite direction.

5. All-Time High Measured Move

- When a market breaks into new all-time highs, traditional resistance is absent.

- Traders often project measured moves based on:

Quick Summary

Measured moves give you logical price targets instead of guessing — crucial for planning entries, exits, and stop losses like a pro.

This post is licensed under CC BY 4.0 by the author.